Cfo Company Vancouver Fundamentals Explained

Wiki Article

What Does Cfo Company Vancouver Mean?

Table of ContentsThe Small Business Accounting Service In Vancouver PDFsSmall Business Accounting Service In Vancouver - TruthsVancouver Tax Accounting Company Things To Know Before You BuyVancouver Accounting Firm for Dummies

That takes place for every solitary transaction you make throughout a provided accountancy period. Working with an accountant can help you hash out those details to make the bookkeeping process job for you.

What do you perform with those numbers? You make changes to the journal entrances to see to it all the numbers include up. That might consist of making corrections to numbers or managing built up products, which are costs or earnings that you sustain but do not yet spend for. That obtains you to the readjusted test equilibrium where all the numbers accumulate.

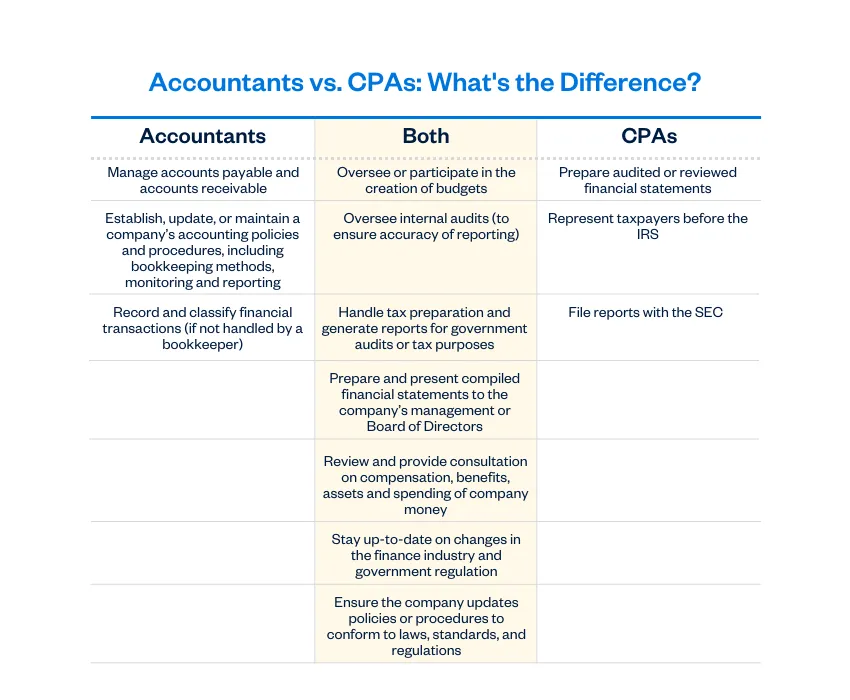

For aiming financing professionals, the question of bookkeeper vs. accounting professional is common. Accountants and also accounting professionals take the same fundamental accountancy programs. Nonetheless, accounting professionals take place for further training and education and learning, which leads to distinctions in their roles, profits assumptions as well as profession development. This overview will provide an in-depth failure of what separates accountants from accounting professionals, so you can comprehend which accounting duty is the most effective suitable for your profession goals now as well as in the future.

Some Known Incorrect Statements About Tax Consultant Vancouver

An accounting professional improves the details given to them by the accountant. Usually, they'll: Review economic statements prepared by a bookkeeper. Assess, interpret or confirm to this info. Transform the information (or records) into a report. Share guidance and make referrals based on what they have actually reported. The documents reported by the accountant will identify the accounting professional's suggestions to management, and also eventually, the health of the organization on the whole.e., federal government agencies, universities, health centers, etc). An educated and skilled bookkeeper with years of experience and first-hand understanding of accounting applications ismost likelymore certified to run guides for your business than a current bookkeeping significant graduate. Keep this in mind when filtering system applications; attempt not to evaluate candidates based upon their education alone.

Future estimates and budgeting can make or damage your company. Your economic documents will certainly play a big duty when it concerns this. Company projections and also trends are based upon your historic monetary data. They are needed to help guarantee your business remains profitable. The monetary data is most reliable Web Site as well as precise when provided with a robust and also structured audit procedure.

Not known Facts About Small Business Accountant Vancouver

A bookkeeper's work is to preserve total records of all cash that has come into as well as gone out of the service. Their records allow accountants to do their tasks.Generally, an accounting professional or proprietor supervises an accountant's job. An accountant is not an accounting professional, neither must they be taken into consideration an accounting professional. Bookkeepers record economic purchases, post debits as well as credit scores, create billings, handle payroll as well as preserve and stabilize the publications. Bookkeepers aren't called for to be licensed to manage the books for more helpful hints their customers or employer yet licensing is offered.

Three main aspects influence your expenses: the solutions you desire, the competence you need as well as your neighborhood market. The bookkeeping solutions your organization demands and the amount of time it takes weekly or monthly to finish them influence exactly how much it costs to hire a bookkeeper. If you require somebody ahead to the workplace once a month to reconcile guides, it will certainly cost much less than if you need to hire somebody full-time to manage your everyday procedures.

Based on that calculation, decide if you require to hire somebody full time, part-time or on a task basis. If you have intricate publications or are generating a great deal of sales, hire a licensed or accredited accountant. A seasoned accountant can provide you assurance and also confidence that your funds are in great hands however they will certainly likewise cost you more.

Not known Details About Outsourced Cfo Services

If you reside in a high-wage state like New York, you'll pay more for an accountant than you would in South Dakota. According to the Bureau of Labor Data (BLS), the nationwide typical income for bookkeepers in 2021 was $45,560 or $21. 90 per hour. There are numerous advantages to employing a bookkeeper to file and also document your business's monetary documents.

They might pursue additional qualifications, such as the CPA. Accounting professionals may likewise hold the setting of bookkeeper. If your accountant does your bookkeeping, you might be paying even more than you need to for this solution as you would typically pay more per hr for an accounting professional than an accountant.

To complete the program, accounting professionals have to have four years of relevant work experience. CFAs have to additionally pass a challenging three-part test that had a pass rate of just 39 percent in September 2021 - tax accountant in Vancouver, BC. The point right here is that hiring a CFA suggests bringing very sophisticated accountancy expertise to your organization.

To receive this accreditation, an accountant has to pass the required exams and also have two Resources years of professional experience. You might hire a CIA if you want a much more specific emphasis on economic risk assessment as well as protection surveillance procedures.

Report this wiki page